Blog

Read our latest posts.

How Does a HELOC Loan Work?

HELOC is short for a Home Equity Line of Credit. A HELOC can make it easy to put your homes’ equity to work for you.

Emergency Fund Basics

If the pandemic has taught us anything, it’s to expect the unexpected. How do you gear up to do that? By having a well-stocked emergency fund. They can help keep you afloat during tough times or simply make it easy to deal with life’s curve balls.

Types of Credit Card Fraud

There are a lot of ways criminals can get your credit card number, but by remaining vigilant or knowledgeable about the various types of fraud will keep you one step ahead.

How to Get the Best Deal On an Auto Loan

Whether you are buying your first car or your fifth, there are few things more exciting than getting behind the wheel of a new car that is all yours. That, it turns out, is not necessarily a good thing. Sometimes we get so wrapped up in the process of shopping for a car — picking the model, homing in on the features, choosing the color — that we forget there’s a second half to the process that is equally important: Shopping for financing.

Refinance vs. Home Equity Loan vs. Home Equity Line of Credit

Refinance. Home Equity Loan. Home Equity Line of Credit. These words all relate to your home, but they have very different meanings. At 4Front we can help you with each one, so here is a little guide to help you understand the difference and see what is right for you.

Save With a Plan

Save with a plan! Develop a savings plan for emergencies and short-term, medium-term, and long-term goals.

Stay Safe While Searching for Love

Finding love online shouldn’t be scary and we hope these tips help you get one step closer to your happily ever after.

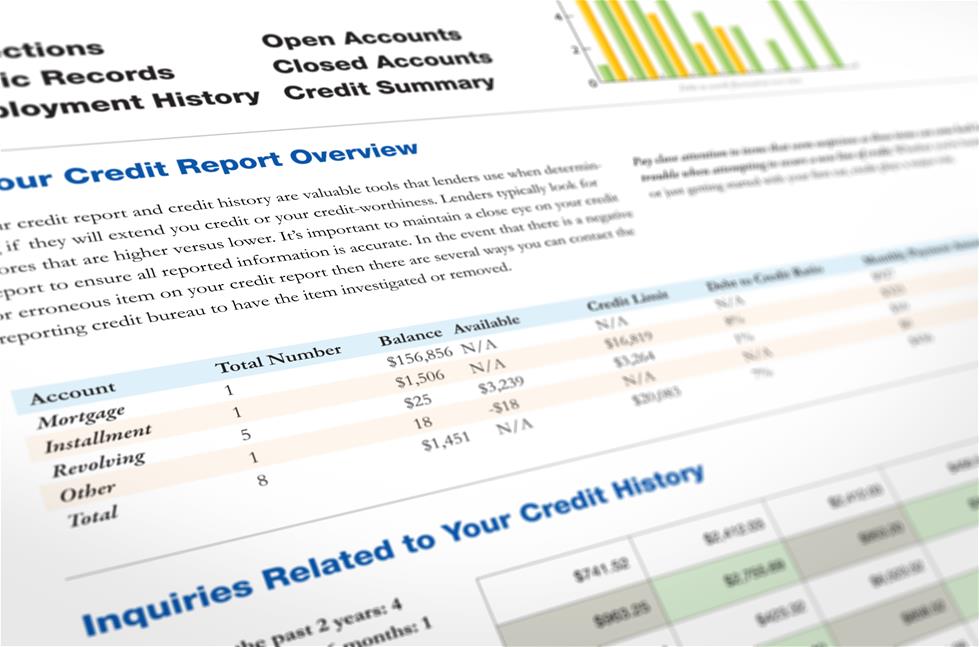

Cleaning up Your Credit Reports

With more than 200 million Americans possessing credit reports, and billions of pieces of data regularly moving to credit reporting bureaus, mistakes, unfortunately, are bound to happen. These guidelines will help dispute with the data.

Things My Grandma Taught Me About Life and Money

The 1950s were a different time but the strategies Grandma used to live on a tight budget can still be useful today.

Six Tips to Avoid Debit Card Fraud

It seems that everywhere you go these days your need to be on the lookout for fraudsters trying to get to your money, but utilize these 6 tactics and you’ll be one step closer to keeping your accounts safe.

Financial New Year’s Resolution

Whether you’re looking to save, boost your credit score, or pay down debt, we think these 6 tips will jump start your year of financial success!

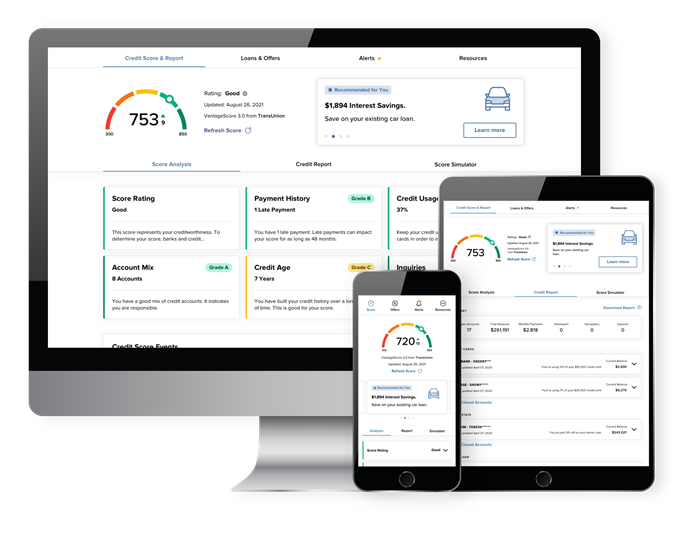

Introduction to Savvy Money

Credit Score Powered by SavvyMoney is available to all 4Front Credit Union members through online banking or in the 4Front Go mobile app. It is a free service offered to help you understand your current credit score, give access to your credit report, provide credit monitoring alerts, and see ways you can save money on new and existing loans with us.

Introduction to Plinqit

Plinqit is a savings platform that will help you save and pay you to learn about money. Set it up and forget about it. Out of sight, out of mind!

Tips for Boosting Your Financial Safety

Financial safety doesn’t need to seem scary, use these five tips, and develop good habits to keep your financial information safe so you can worry less, and enjoy more.

The Story of 4Front Credit Union

Formed in 2015 from the merge of Bay Winds and Members Credit Unions, 4Front Credit Union is a member-owned financial cooperative serving more than 90,000 members across Michigan.Ready to join? Let's get started.

Wherever you are on your financial journey, we make banking smart and simple.