Blog

Read our latest posts.

What Do Lenders Look for When You Apply for a Loan?

To increase your chances of getting a loan, understand what lenders look for. They prioritize a high credit score, so check and improve yours by paying bills on time. Lenders also assess your income, employment stability, and debt-to-income ratio, preferring a ratio of 30% or less. Having significant savings or investments can also boost your application. Ensure your credit score is high before applying.

Best Practices for Using a Credit Card

To maximize the benefits of a credit card, choose the right one based on your spending habits and priorities, avoiding high fees and interest rates. Pay your balance in full and on time to build your credit score and avoid interest. Keep your credit utilization below 30% to maintain a healthy score. Use your card regularly to demonstrate responsible borrowing and repayment. Diversify your credit with other loans like auto or mortgage loans to further boost your credit score by showing a consistent payment history.

How Long Does It Take My Credit Report to Update?

Credit reports are updated every 30 to 45 days when lenders report to the major bureaus (Equifax, Experian, TransUnion), so improvements in your score may not appear immediately despite weekly report checks. Rapid rescoring can expedite updates, but it may incur a fee and doesn't guarantee a positive outcome. To maintain a healthy credit score, pay bills on time, keep credit card usage below 30%, retain older accounts, diversify credit types, and apply for new credit only when necessary. Building a strong credit score requires consistent, long-term financial habits.

Reasons to Refinance

Refinancing a loan can offer several benefits, including a lower interest rate, reduced monthly payments, a shorter loan term, or extra cash through a cash-out refinance. It can also allow you to switch loan types, such as from an adjustable to a fixed-rate mortgage. However, refinancing comes with potential downsides like extending the loan term, increased total interest payments, and additional fees. It's important to carefully consider these factors to ensure refinancing is advantageous for your situation..jpeg?sfvrsn=392eb770_1)

What’s the Difference Between a Mortgage Refinance, a Home Equity Loan, and a HELOC?

With rising interest rates, now is a good time to consider consolidating high-interest debt into lower-interest options. Homeowners can refinance their mortgage, get a home equity loan, or use a home equity line of credit (HELOC). Refinancing can lower your mortgage rate, a home equity loan provides a lump sum with fixed payments, and a HELOC offers flexible, variable-rate borrowing. These options can help manage debt more effectively, but caution is needed as consolidating unsecured debt into secured debt like a home loan risks foreclosure if payments are missed.

Looking at Fixed-Rate Mortgages vs Variable-Rate Mortgages

When choosing a mortgage, you need to decide between a fixed-rate and a variable-rate loan. A fixed-rate mortgage offers a constant interest rate throughout the loan term, ensuring predictable monthly payments and making budgeting easier. However, it comes with higher rates and expensive fees if you need to break the loan. On the other hand, a variable-rate mortgage has payments that fluctuate with the lender’s rate, potentially saving you money if rates decrease and offering cheaper exit fees. The downside is the unpredictability of payments and the potential difficulty in switching to a fixed-rate mortgage if rates are high.

Donating to Charity

To donate effectively, choose a cause you're passionate about or a specific community you want to support. Use websites like volunteermatch.org to find local charities. Verify legitimacy through sites like Charity Navigator, Give.org, or Great Nonprofits. Trust your instincts and avoid charities that seem suspicious. Besides money, you can donate time, skills, or items like food and blankets. There are numerous ways to contribute positively without straining your budget.

Quality vs Cost

When deciding between quality and cost, consider that higher prices may reflect better materials, durability, and brand reputation, but not always. Lower prices don't always mean poor quality. Sellers may price higher to create a perception of better quality. Evaluate reviews, necessity, and potential risks before purchasing. Balance what you're willing to risk against what you need to prioritize, and do thorough research to find where you can save or should spend more.

GreenPath: A Road to Financial Wellness

GreenPath is a non-profit offering financial counseling, education, and solutions for those facing debt or financial stress. They provide free general counseling, debt management plans, and educational resources. Their services help people manage debt, negotiate with creditors, and build financial wellness. Contact them at (844) 572-5922 for confidential support.

Investment Warning Signs and Red Flags

Minimize investment risk by being wary of free advice, especially in high-pressure seminars. Avoid complex investments like OTC and penny stocks. Scrutinize and minimize investment fees. Be cautious with low liquidity investments like real estate partnerships and callable CDs. Avoid highly volatile derivative investments. Stay alert to scams and unsolicited investment offers.

Investing

Investing helps money grow by putting it into stocks, real estate, etc., with potential high returns over time despite risks. Unlike saving for short-term goals with guaranteed returns, investing is for long-term goals, often offering higher growth but with possible losses and withdrawal delays. Even small investments can grow significantly if started early. Choose between saving and investing based on your goals and timeline.

Spending Money

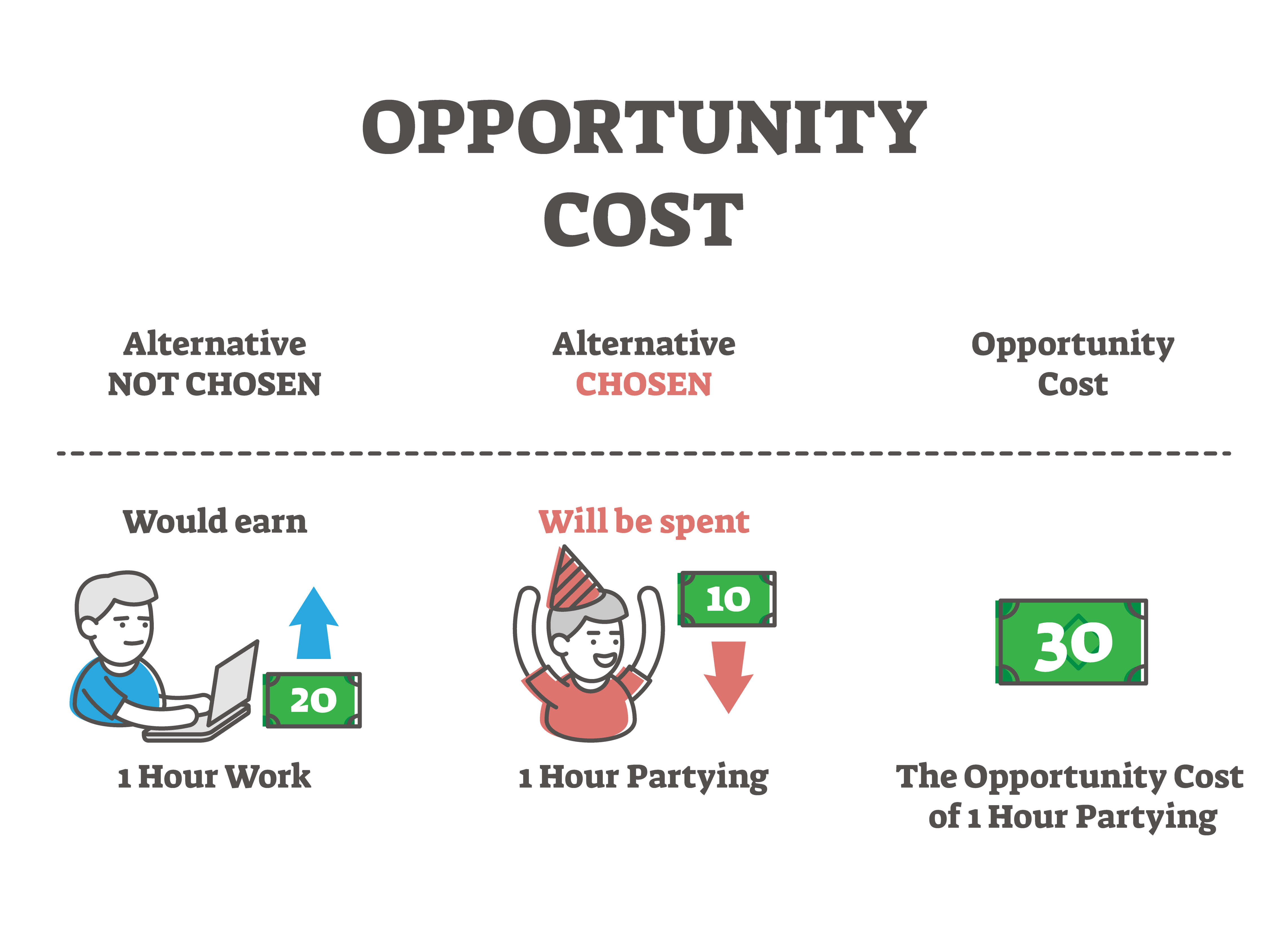

When you earn income, deciding how to spend it is key to money management. Every purchase has an opportunity cost, meaning choosing one item means giving up another. Evaluate needs versus wants and avoid spending due to peer pressure or misleading ads. Consider sharing costs, borrowing, or trading. Use cash, checks, debit, or credit cards wisely, noting that credit cards incur interest if not paid off monthly. Practicing good spending habits now helps ensure better financial decisions in the future.

Personalizing Your Budget

To make budgeting work for you, rethink it as a tool for freedom, spending on fun, and achieving savings goals. Set short-term goals and break them into weekly benchmarks to stay motivated. Use budgeting apps to simplify the process, helping with tasks like finding unused subscriptions and saving on transactions.

A Simple Guide to Simple Budgeting

Creating a budget helps you take control of your finances. Start by understanding your income and tracking your spending for a month. Categorize expenses, set financial goals, and create a budget plan. Use budgeting tools and review your budget regularly. Prioritize savings, be flexible for unexpected expenses, and celebrate small wins to stay motivated. Budgeting is a powerful tool for financial stability and reducing stress.

Income and Expenses

Income and expenses are the foundation of a budget. Income includes money from jobs, interest, and investments, while expenses cover both needs (like food, housing, and utilities) and wants (like dining out and entertainment). For a sustainable budget, income should exceed expenses. The 50/30/20 rule suggests spending 50% on needs, 30% on wants, and saving 20%. To balance a budget, you can decrease expenses by cutting variable costs or increase income through additional jobs or better-paying employment. Regularly reassessing your budget is essential to accommodate life changes.

How to Become a Young Entrepreneur

Starting a business as a young entrepreneur involves several key steps: identifying your business idea based on your strengths and interests, understanding your ideal customer, and securing initial funding through methods like savings, odd jobs, or support from adults. Ongoing costs and legal requirements, such as state regulations and business licenses, must be considered. Setting up a separate business account, exploring payment options, and developing a business plan are essential. Finding a mentor and maintaining a growth mindset will help navigate challenges and ensure continuous learning and growth.

50/30/20 Rule

The 50/30/20 rule is a simple budgeting method that divides after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings. It's a guideline to help manage finances without complexity. Needs include essentials like housing, transportation, and insurance; wants are non-essentials like vacations and hobbies; and savings ensure financial security for emergencies and retirement. The rule emphasizes simplicity and adaptability, encouraging individuals to adjust based on their financial situation and goals. It promotes financial literacy and responsible money management.

What is Financial Literacy?

Financial literacy involves understanding and managing finances effectively, starting from basic money concepts in childhood to advanced financial strategies in adulthood. It's a continuous learning process with no set start or end point. Mastering financial literacy involves setting goals, planning, and consistently applying money management skills, such as budgeting, saving, and investing. Achieving financial literacy helps maintain financial health and avoid debt, leading to greater financial stability and success.

What is a HELOC?

A Home Equity Line of Credit (HELOC) lets you borrow against your home's equity with a revolving credit line similar to a credit card. The credit limit depends on the loan-to-value (LTV) ratio set by the lender. Unlike credit cards, HELOCs have a draw period (usually 10 years) for withdrawals and a repayment period (10-20 years) for paying back principal and interest. Qualification depends on debt-to-income ratio and credit score. Risks include putting your home as collateral, variable interest rates, and potential overborrowing. HELOCs are often used for home renovations, with possible tax-deductible interest. Alternatives include home equity loans for lump-sum borrowing.Ready to join? Let's get started.

Wherever you are on your financial journey, we make banking smart and simple.